Decentralized Finance (DeFi) is revolutionizing the financial landscape by offering open, efficient, and transparent financial services. This comprehensive guide delves into the world of DeFi, exploring its evolution, key components, advantages, and challenges. From smart contracts and DApps to yield farming and liquidity pools, we unpack the mechanisms that make DeFi a powerful alternative to traditional finance. Despite its potential, DeFi comes with its share of risks, and this guide doesn’t shy away from discussing them. As we look towards a future where DeFi could become the norm, this article serves as an essential resource for understanding this transformative technology.

Table of Contents

Toggle

Table of Contents

ToggleIntroduction to Decentralized Finance (DeFi)

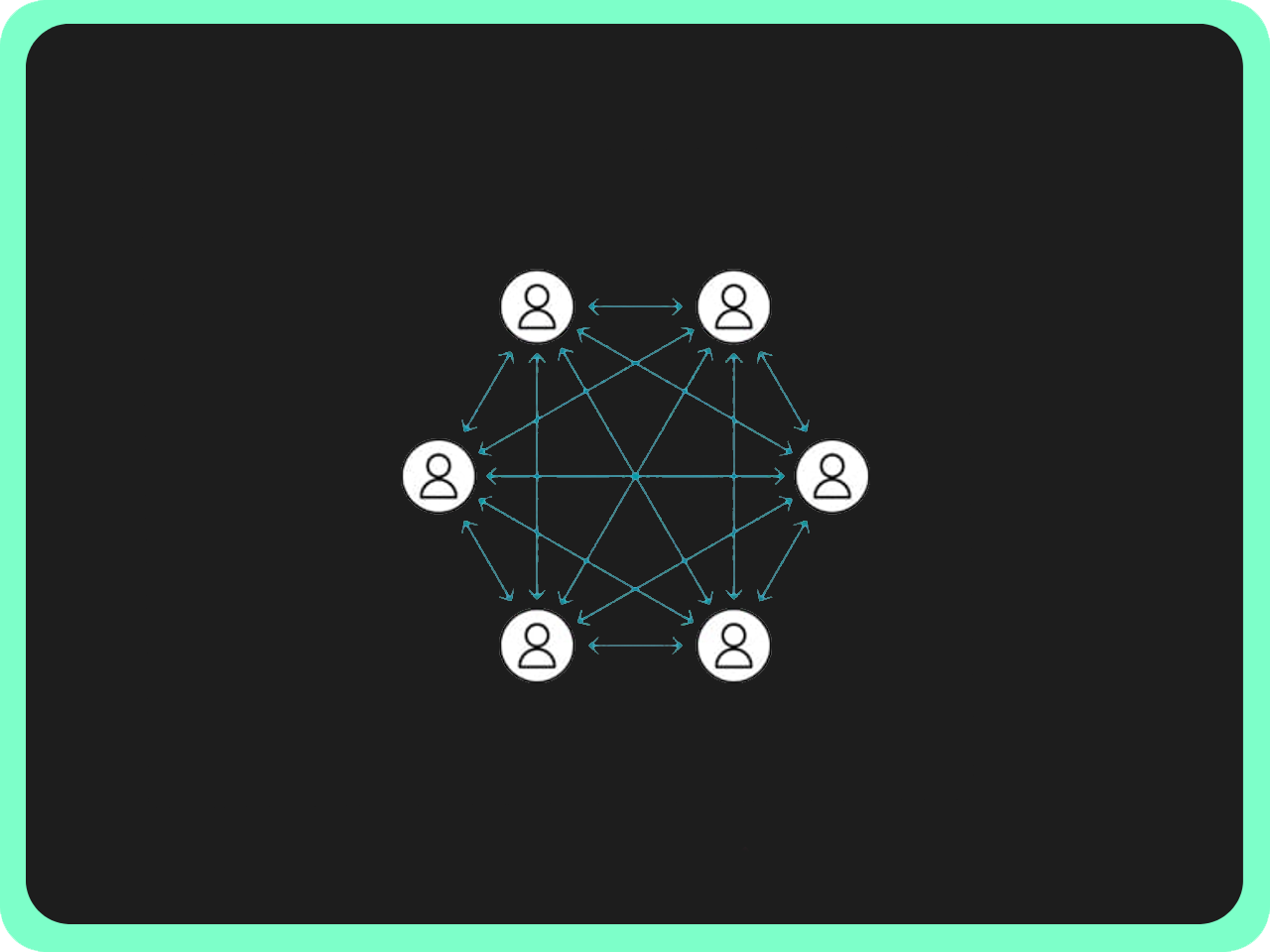

Decentralized Finance, often referred to as DeFi, is a disruptive financial system built on blockchain technology. It aims to democratize finance by eliminating intermediaries and enabling direct peer-to-peer transactions. DeFi leverages smart contracts on blockchain networks, most notably Ethereum, to recreate and improve upon traditional financial instruments and services, including lending and borrowing, insurance, asset trading, and more.

The Evolution of DeFi

The concept of DeFi isn’t entirely new. It has its roots in the advent of Bitcoin, the first decentralized currency. However, the term “DeFi” and the broader ecosystem around it started to take shape with the development of Ethereum and its ability to execute smart contracts. The DeFi movement has seen exponential growth in recent years, with billions of dollars now locked in various DeFi protocols.

Key Components of DeFi

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute transactions when predefined conditions are met, eliminating the need for an intermediary.

DApps (Decentralized Applications)

DApps are applications that run on a decentralized network, leveraging smart contracts to perform their functions. They are open-source and operate autonomously, with data and records of operation stored on the blockchain.

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are platforms that allow for direct peer-to-peer cryptocurrency transactions to take place online securely and without the need for an intermediary.

Stablecoins

Stablecoins are a type of cryptocurrency designed to minimize the volatility of the price of the stablecoin, relative to some “stable” asset or a basket of assets. They are often pegged to a cryptocurrency, fiat money, or exchange-traded commodities.

Yield Farming

Yield farming, also referred to as liquidity mining, is a way to generate rewards with cryptocurrency holdings. In simple terms, it means locking up cryptocurrencies and getting rewards.

Liquidity Pools

In DeFi, liquidity pools are used to facilitate decentralized trading, lending, and many more functions. Liquidity pools are pools of tokens locked in a smart contract.

Advantages and Disadvantages of DeFi

Advantages

Open and Accessible: DeFi is open to anyone with an internet connection. It doesn’t require any ID verification or minimum deposits, making it accessible to people worldwide, including those in unbanked or underbanked regions.

Interoperability: DeFi applications are built on public blockchains like Ethereum, which means they can interact with each other. This interoperability allows users to seamlessly switch between services.

Transparency: All transactions on DeFi platforms are recorded on the blockchain, providing an unprecedented level of transparency and auditability.

Ownership: In DeFi, users have full control over their assets. They can move their assets whenever they want, without the need for a middleman.

Disadvantages

Smart Contract Risk: Smart contracts are still relatively new and can contain bugs or vulnerabilities that can be exploited by malicious actors.

Complexity: DeFi can be complex and hard to understand for the average user, which can lead to costly mistakes.

Lack of Regulation: The lack of regulation in the DeFi space can be a double-edged sword. While it allows for innovation and freedom, it also means there’s little recourse for users if things go wrong.

Risks and Challenges in DeFi

While DeFi has significant potential, it’s not without its risks and challenges. These include smart contract vulnerabilities, price volatility, regulatory uncertainty, and the risk of “rug pulls” or scams. Users must do their due diligence and understand the risks before participating in the DeFi space.

The Future of DeFi

Despite the risks and challenges, the future of DeFi looks promising. With ongoing innovation and development, DeFi has the potential to revolutionize the financial industry, making it more open, inclusive, and efficient. However, for DeFi to reach its full potential, it must overcome its current challenges and risks.

Conclusion

Decentralized finance (DeFi) is a powerful concept that has the potential to democratize access to financial services. While it’s still in its early stages and has its share of challenges, the future of DeFi looks promising. As with any emerging technology, education and understanding are key. So, whether you’re a seasoned crypto enthusiast or new to the space, it’s important to do your research and understand the risks before diving in.